Responsible Investment

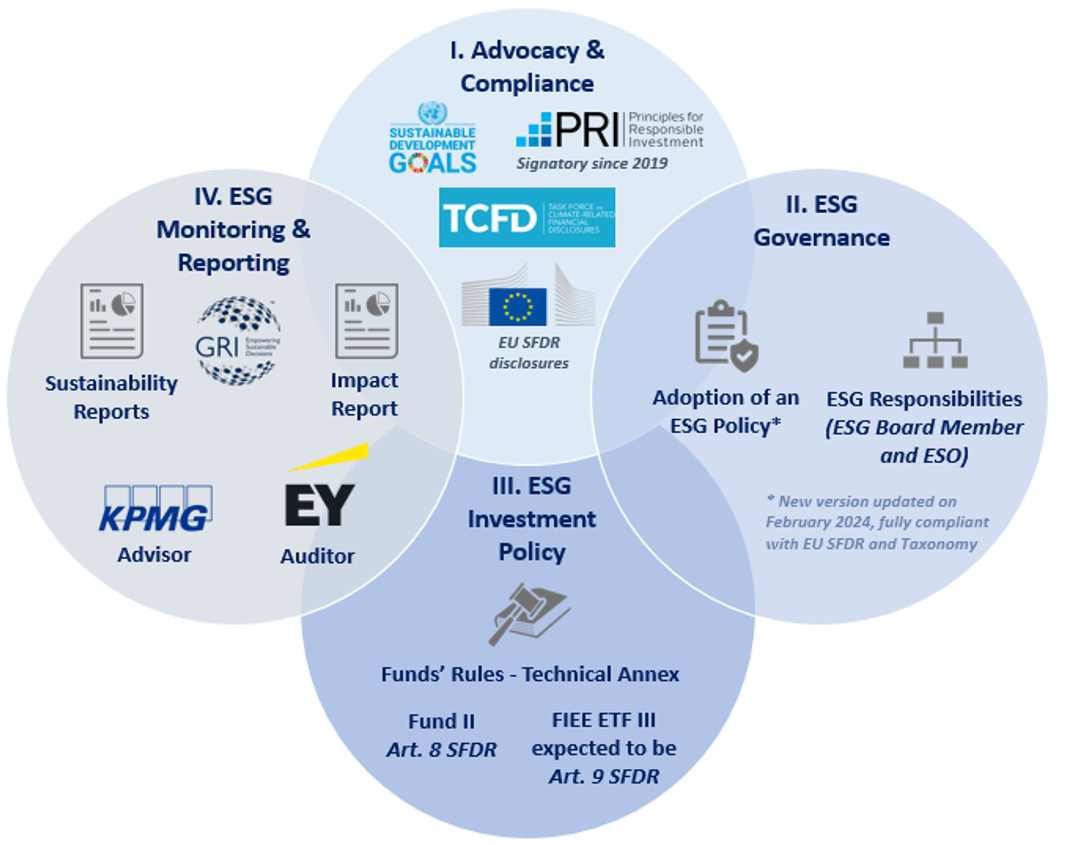

FIEE SGR has pursued a path of transparency and accountability in the area of sustainability and commitment to Environmental, Social and Governance (ESG) goals since its start-up.

- Pursues the Sustainable Development Goals promoted by the 2030 Agenda, in particular by co-participating in SDGs number 7 (affordable & clean energy), 9 (industry innovation & infrastructure), 11 (sustainable cities / communities) and 13 (climate action) that directly involve the Funds’ investments and adheres to the UN PRI (United Nations Principles for Responsible Investment).

- It has an internal Environmental and Social Management System (ESG Policy), which includes an Environmental and Social Officer (“ESO”) responsible for ensuring compliance with the ESG commitments of the Funds’ investments and the regular monitoring of objectives in this area.

- Implements a sustainable investment policy for the Funds, in accordance with the commitments in eligible investments set out in the Regulations.

ESG Performance

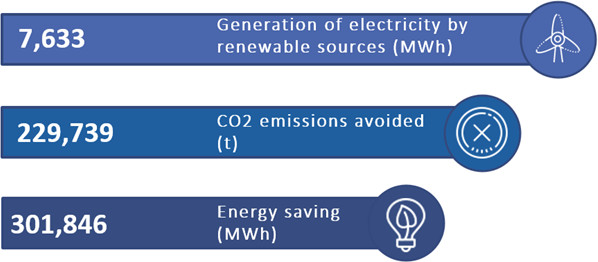

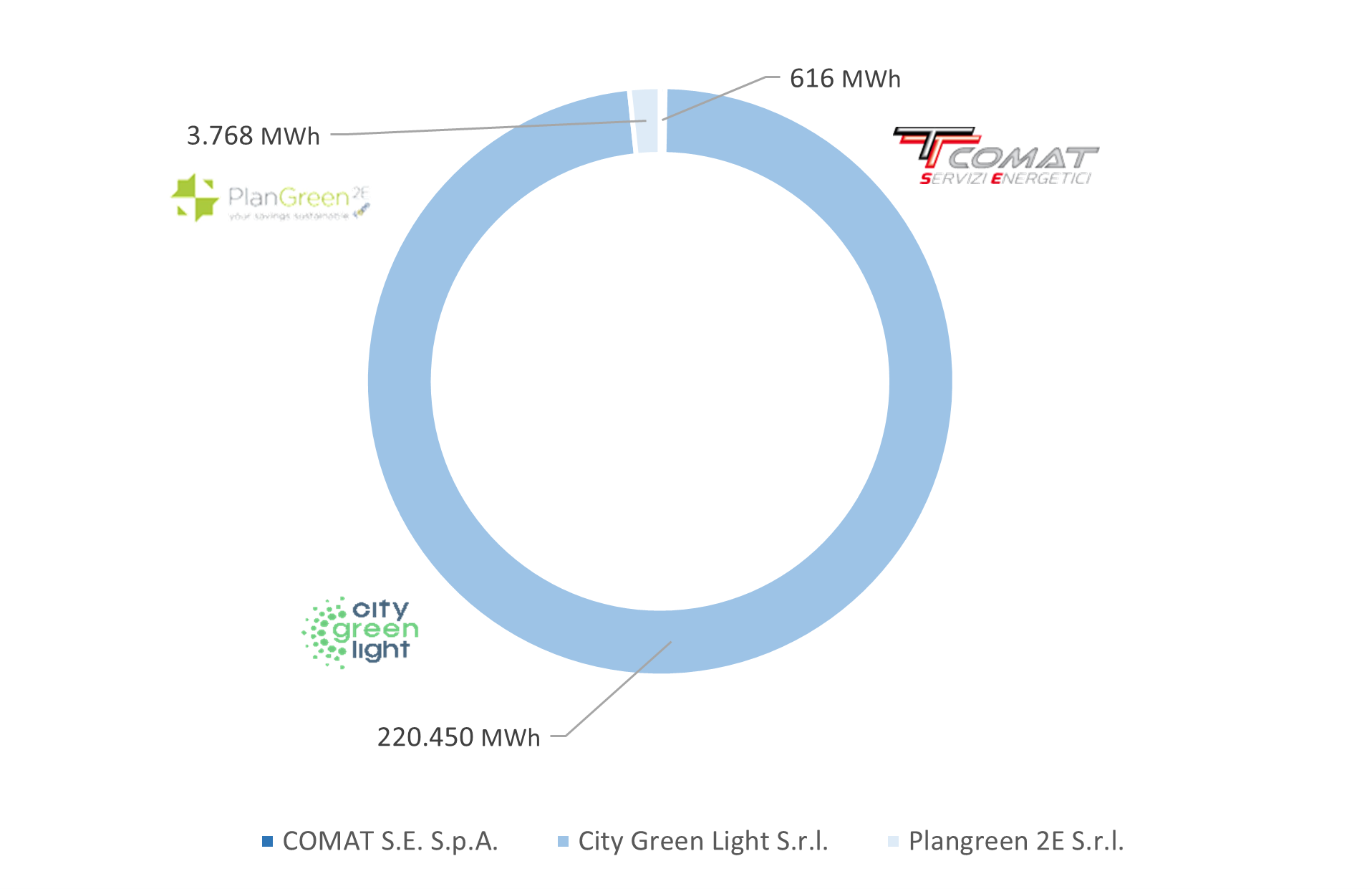

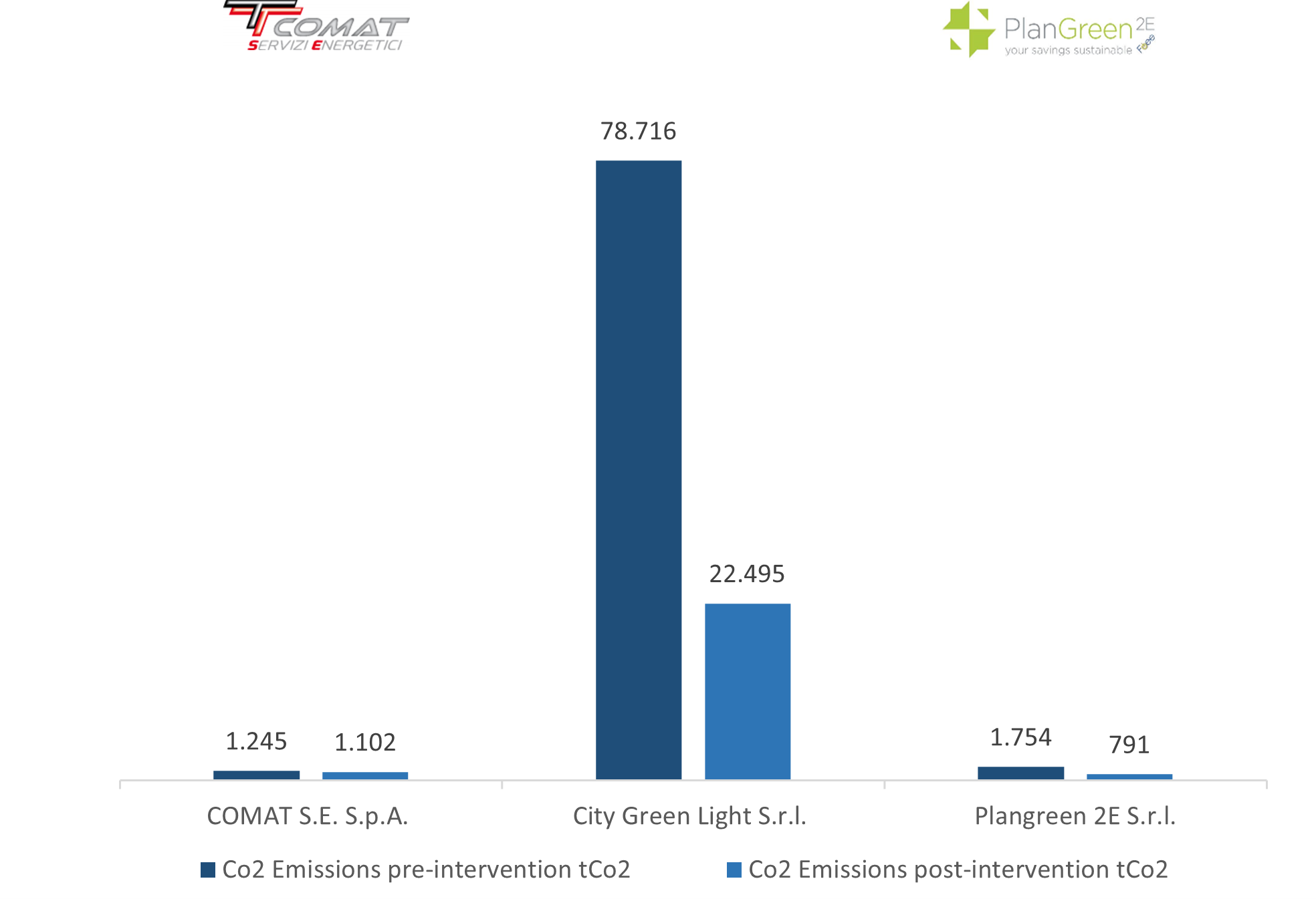

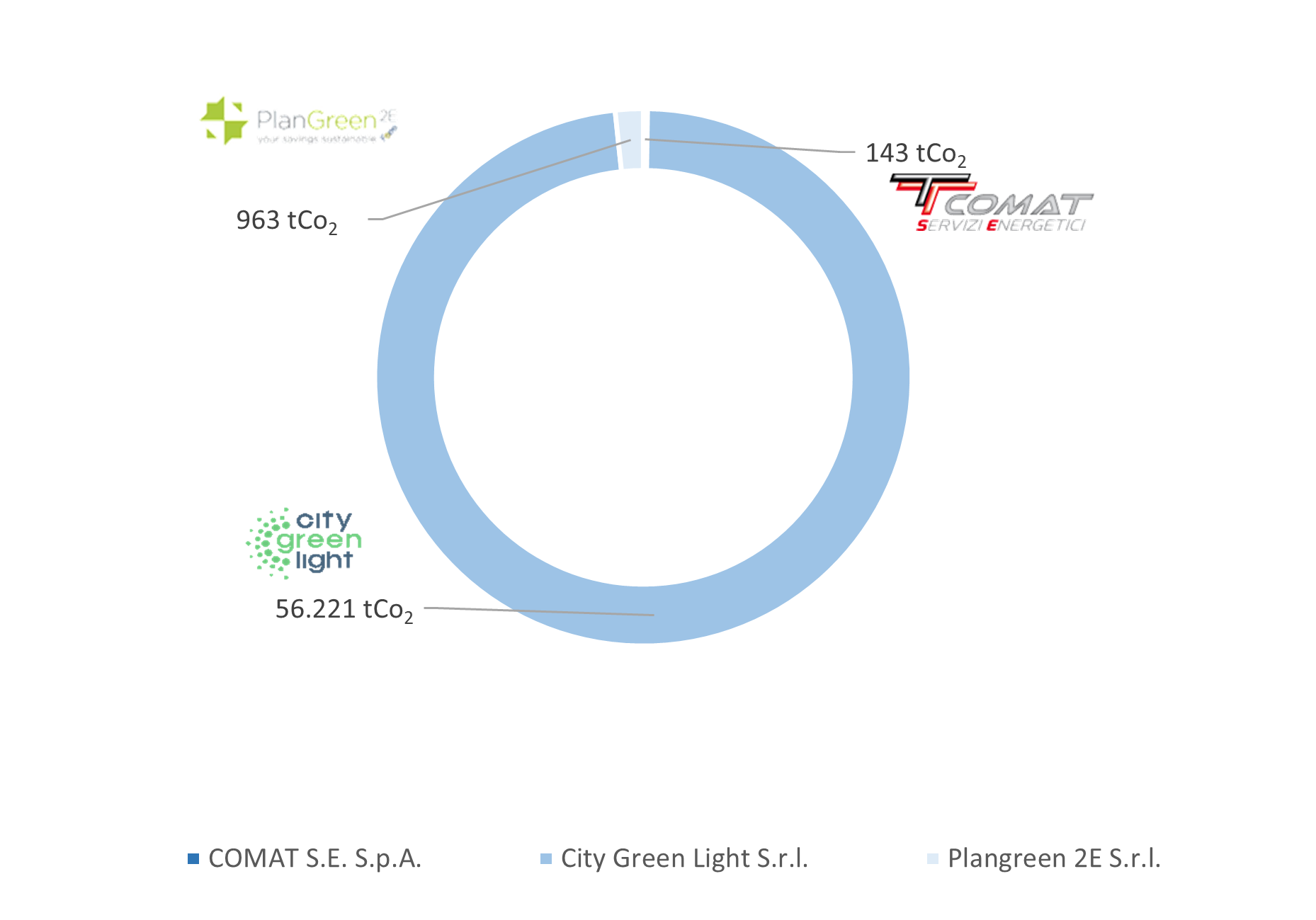

Aggregating the results of the Fund’s investee companies, the following savings were achieved in 2022:

Fund I

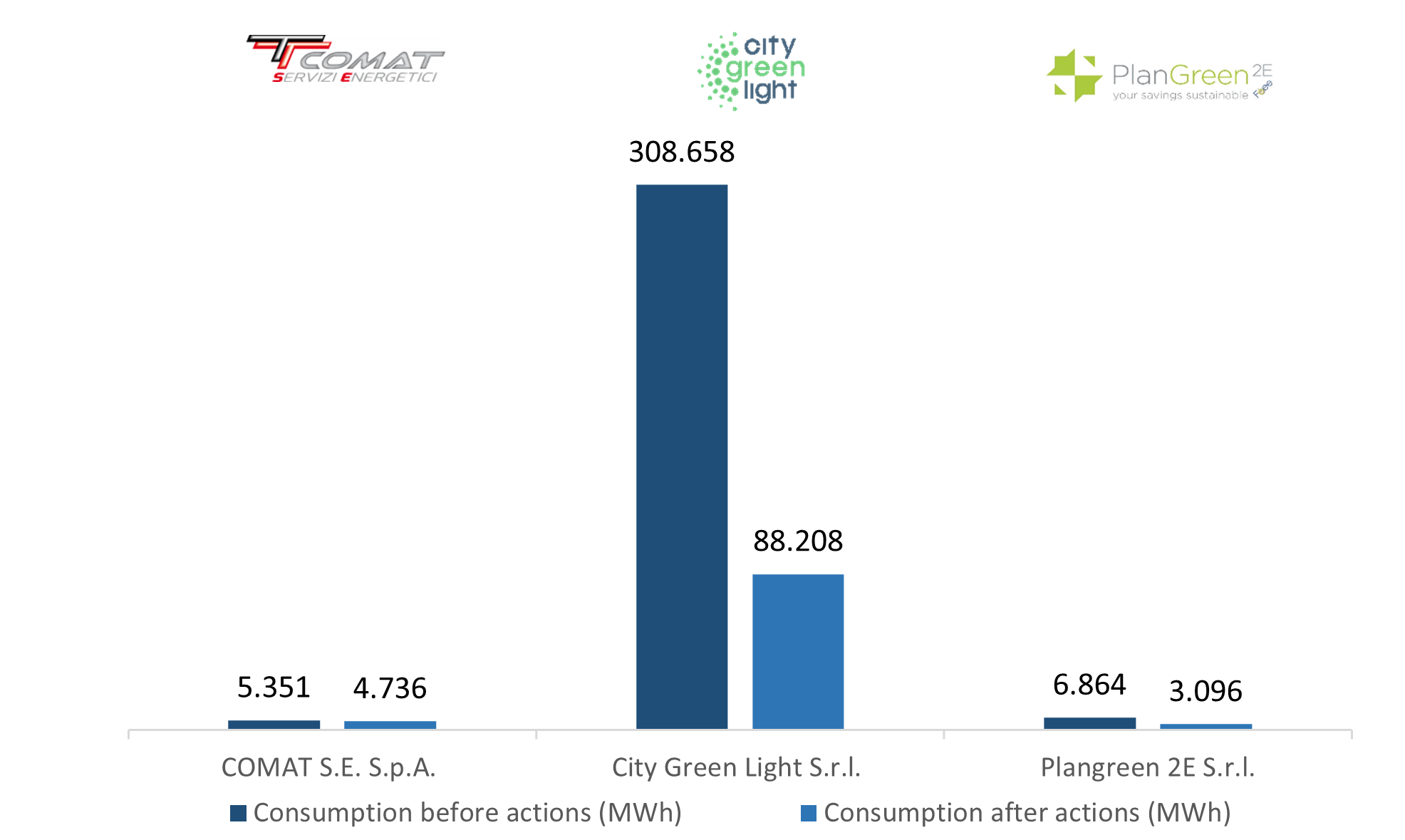

Energy consumption pre and post intervention (MWh)

Energy saving (MWh)

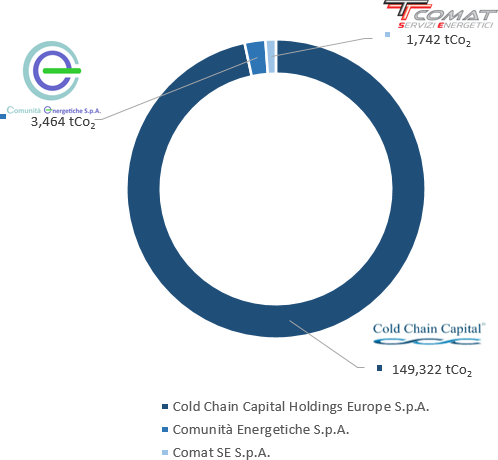

Total emissions of CO2 Pre and Post Intervention

Tons of CO2 avoided emissions

Fund II

Tons of CO2 avoided emissions