Investments

Vision

Investment Policy

The Investment Team pursues a strategy of holding a diversified portfolio of investments with the aim of maximising returns on invested capital.

The Team works to identify opportunities which:

- are diversified and sizeable at the same time;

- have repayment times of 8-10 years to allow for an exit in line with the funds’ duration of 10-12 years;

- are exposed to creditworthy and reputable ultimate customers;

- allow good returns to achieve the funds’ expected returns in the range of 10% – 12%

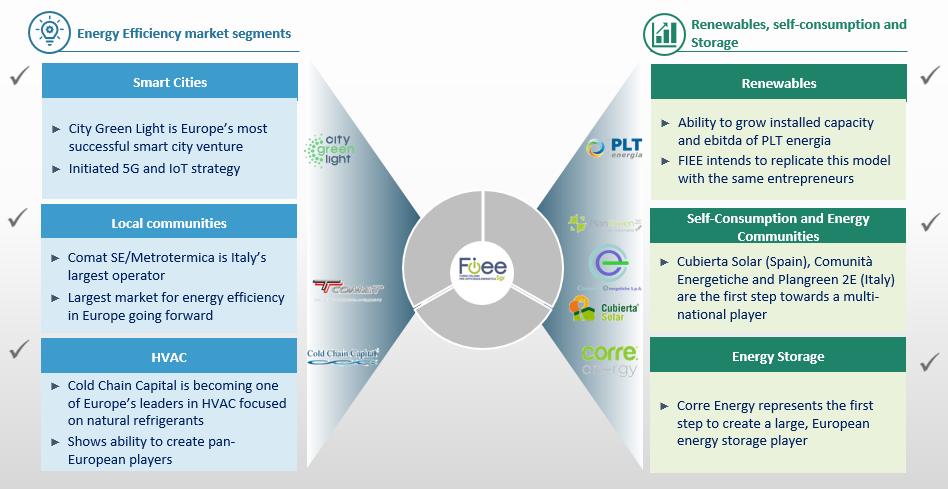

The total potential investments currently under analysis amount to € 200 million and focus on the following segments of the new energy paradigm with the aim of contributing to the development of energy transition platforms.

- Energy efficiency (public and private lighting, co-generation and tri-generation, energy efficiency in companies’ production processes, energy service in buildings, HVACR equipment and systems, district heating and remote cooling systems, etc.).

- Power generation from renewable sources (wind, solar photovoltaic, bio-methane, etc.).

- Other innovative infrastructure related to energy transition (energy storage systems, hydrogen, transport electrification, energy communities, systems integration, connectivity, smart cities, etc.).

Portfolio

7

Companies currently in portfolio, after divestments

1000+

Employees

Over € 2 billion

capex performed or in progress in the energy transition

In December 2022, PLT Energia (invested by both funds) was sold to ENI Plenitude.

Fund I also finalised in May 2023 the sale of Selettra S.p.A. to the German private equity fund managed by PATRIZIA Infrastructure Ltd and in September 2023 the sale of Comat SE S.p.A. to two investment funds managed by Pioneer Point Partners LLP and Marguerite III GP S.à r.l., respectively.

7,663 MWh

Generation from renewable sources

229,739 tCO2

CO2 avoided emissions

301,846 MWh

Energy savings

Data 2023