Fund I

Fund I is the first closed-end alternative investment fund promoted and managed by FIEE SGR.

Fund I is the first closed-end alternative investment fund promoted and managed by FIEE SGR.

Fund I was established in July 2016 and reached a size of € 166 million in 20 December 2017, exceeding its initial target of € 150 million.

In May 2020, Fund I closed its investment period ahead of schedule, ultimately investing in six portfolio companies.

As of 2023, Fund I has two companies in its portfolio.

In December 2022, the investee PLT Energia was fully sold to Eni Plenitude at a total price of € 900 million. Fund I sold its respective shareholding.

The transaction generated high returns for the fund.

Also in December 2022, Selettra S.p.A. finalised the sale of 100% of Selettra Pubblica Illuminazione S.r.l. to PATRIZIA Infrastructure Ltd.

Selettra Pubblica Illuminazione was the Public Lighting division of Selettra S.p.A. and was sold at an Enterprise Value of EUR 92 million.

In May 2023, Fund I completed the sale of the stake to PATRIZIA Infrastructure Ltd, generating a high return.

In September 2023, Fund I completed the sale of Comat SE S.p.A. to two investment funds managed by Pioneer Point Partners LLP and Marguerite III GP S.à r.l., respectively.

Both transactions generated high returns for the fund.

Fund I is well established as a leading investor and partner in the energy efficiency market in Italy by providing venture capital for development and specific industrial expertise.

Through its two existing investments, Fund I is currently the first Italian private operator in public lighting and among the top three in residential energy services.

2

Subsidiaries

190+

Employees

€ 150 mln

Turnover

€ 55 mln

EBITDA

75,211 tCO2

CO2 emissions avoided

294,253 MWh

Energy saved

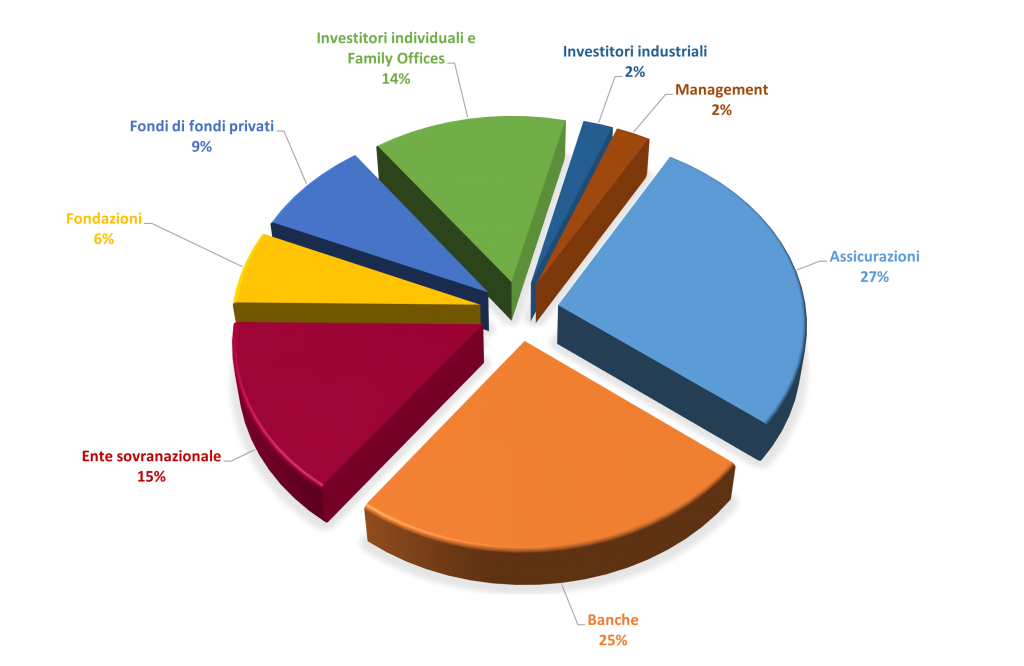

Investors

Investors, depending on the different share classes subscribed, fall into two main categories:

- Qualified Investors: professional and retail investors, subscribers of A units amounting to a total of € 162 million;

- Management of FIEE SGR: subscribers of A units amounting to € 2.5 million and of B units amounting to € 1.5 million.

The chart below shows the breakdown of the fund’s inflows by investor class.

With a subscription commitment of € 25 million, the European Investment Bank assumed the role of anchor investor in Fund I.

Advisory Board

A collegial body representing investors that acts in an advisory or binding capacity, pursuant to the Fund’s Regulations.

The Advisory Board expresses its non-binding opinion in relation to matters of particular relevance to the Fund. In addition, the Board of Directors requests the prior consent or approval of the Advisory Board with regard to certain cases provided for in the Fund’s Regulations, such as, for example, cases in which investment thresholds are exceeded, transactions involving conflicts of interest or co-investments.